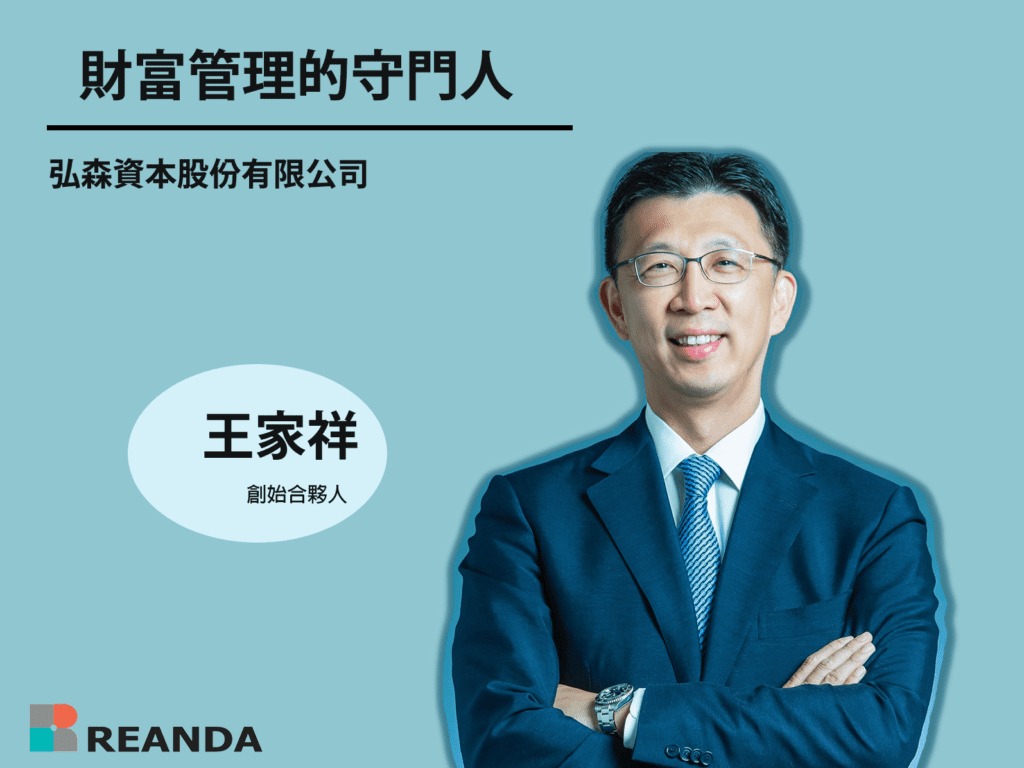

The gatekeeper dedicated to wealth management – Wang Jiaxiang

Primary Education: Master of Business Administration (MBA) in Financial Management from City University, Washington, USA. Key experience: Researcher at Jinghua Securities (now Yuanta Securities), responsible for Initial Public Offering (IPO) projects from 1999 to 2003. His motivation for entering the field was influenced by his father-in-law, Wu Guofeng, who was one of the founders of one of the “Big Four” accounting firms, KPMG. Head of Wealth Management Department at Citibank, overseeing wealth management services from 2003 to 2014. He joined this field due to his enjoyment of interacting with various people. Vice President at a UBS private banking, handling specialized financial projects from 2014 to 2016. He entered the foreign banking sector to challenge himself. Present position: Founder of WL Capital, established in 2016. The company’s products include wealth management, capital fundraising, corporate listings, and mergers and acquisitions. He combines the goals of his career with networking.Financial Products: – Asset allocation, including private fund investment and establishment, trust and insurance structures and succession planning, family office setup and planning.Word-of-Mouth Marketing: – Customer referrals (MGM).Revenue Business: – Advisory fees and performance fees. Wang Jiaxiang has over 20 years of extensive experience as a senior executive in the global capital markets and private banking. He offers high-end private wealth management services tailored to clients’ needs. He has held the distinction of managing the highest net growth in asset scale at a foreign bank in Taiwan. He is not only viewed as a financial expert by clients but also as the top business manager within the company’s team. Q1.What personality traits do you have that are suitable for the financial industry? Wang: I believe I possess the personality traits of passion, sharing, resilience, and a willingness to take risks. The financial industry requires endurance, perseverance, expertise, and trustworthiness. My personal traits align well with the characteristics of the industry, allowing me to not only apply what I’ve learned but also derive a sense of achievement from my work. Q2. What inspired you to enter the financial industry during your educational journey? Wang: I initially planned to major in Information Management when studying abroad. However, I was inspired to switch my major to finance when a classmate invited me to invest in stocks and we had a successful experience. This decision laid the foundation for developing my expertise in financial management. Additionally, a background in finance is highly advantageous for career development in a field that emphasizes professionalism and expertise. Q3. What is your most significant achievement and challenge in your career so far? Why have you chosen to stay in the financial industry? Wang: I believe my most significant achievement stems from earning the trust of clients. Whether it’s B2C(Business-to-consumer) clients tailored to their preferences or B2B(Business-to-business) clients aligned with the company’s culture, the fascinating aspect of the financial industry is that it often leads to mutually beneficial career development for both parties. However, the biggest challenge was starting a business with just 250,000 New Taiwan Dollars (approximately $9,000) with a total of five co-investors (each contributing 50,000 NTD) and no bank loans. I think all industries, including agriculture, require reliance on banks and provide opportunities to interact with various people. Since the beginning of my career, I have been building trust with clients, and facing the unpredictable financial environment based on my expertise has allowed me to shift from “self-fulfillment” to “serving others.” I believe that agriculture, industry and commerce are dependent on banks and have access to all kinds of people, and I have been building trust with customers since I entered the industry, and my expertise in the face of the unpredictable financial environment has allowed me to move from “self-satisfaction” to “serving others” in the financial industry. Q4. Do you prefer handling domestic or overseas corporate financing cases? Among the companies you have worked with for listings, which client left the most significant impression on you? Wang: This question reminds me of a story about the financial approach of Wang Yongqing, the late founder of the Formosa Plastics Group. According to media reports, Wang Yongqing’s assets were estimated to be around 58 billion New Taiwan Dollars (approximately $2 billion). His inheritance tax alone was as high as 12 billion NTD, so he invested 600 billion NTD overseas, with a domestic-to-overseas property ratio of 1:10. This illustrates that even the business genius Wang Yongqing was cautious about overseas investments. Regarding the two cases I would like to highlight: 1. Yichang Yufang(億長御坊): It is a second-generation-led company focused on sales as the main business. To achieve their goal of expanding into the Asian market, they decided to transform a 60-year-old enterprise and continue the legacy of being known as the “world’s best.” 2. Shangjing: It is the largest Japanese restaurant in China, which is also planning to go public in Taiwan. With a history of 15 years in China, they are currently focusing on salmon production, representing a case of generational transformation. Q5. What introductory advice do you have for the general public and corporate entities in the field of financial management? As someone experienced in managing personal wealth and foreign banking, what is your opinion and advice? For individuals who are currently studying or considering transitioning into the financial industry, what advice can you provide? Wang: I would recommend that individuals focus on three main aspects of personal financial investment: stocks, bonds, and real-estate. Personally, I prefer stock investments, and it remains one of my sources of income. For businesses, I recommend nurturing professional managers (poaching from the same industry is acceptable but not ideal) who can integrate the entire industry chain, adapt to the changing post-pandemic economy, and recruit talent and funds through initial public offerings (IPOs). Additionally, I suggest that companies find a “corporate doctor,” and I would recommend “Reanda M Y Wu & Co.,CPAs” for comprehensive tax planning assistance. This not only helps with tax savings for domestic operations but also provides assistance in referring clients in expanding their business. I have benefited greatly from my